Table of Content

However, it means that no other deductions can be claimed eg for phone, internet, computer consumables & equipment, stationery etc). Asset depreciation on items used for work purposes will require a separate depreciation calculation. Employees will not require a separate home office or dedicated work area to claim the deduction, but normal substantiation rules apply. Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions. Also, work from home expenses can only be written off if they exceed 2% of adjustable gross income. As is the case with most tax matters, tax payers may be required to show receipts and other documentation of deductible expenses.

Much like all of the other categories, these supplies could also be used for non-work related purposes so it’s important to only claim deductions on reasonable quantities of use for your role. For example, buying 200 printer ink cartridges in the space of a month as a copywriter to claim a deduction on all of these purchses is likely to be flagged in your tax return, which may result in an audit. Claiming a tax deduction for home office expenses isn’t as simple as saving receipts for every purchase and adding them into your tax return. There are several categories of both large and small expenses which can be claimed back as work related. The ATO is watching out for people still claiming travel expenses and laundry expenses even though they’re working from home full time.

Using ato.gov.au

This does not require a separate home office or dedicated work area set aside in the home. If there is no regular pattern, then records of the duration and purpose of each occasion would need to be kept. There is an overall requirement that the basis of claims calculations be “reasonable”. Your return will be reviewed and checked by two Etax accountants before lodgement – giving you the confidence it was done right.

For the duration of this period, the ATO allows home office deduction claims without the need for you to have an actual office. So you can now claim home office expenses if you work from the kitchen table or from your sofa. One advantage of the shortcut method is that taxpayers do not require a dedicated workspace at home, a necessity for the other two ways to claim.

ATO Social

Whether you work for yourself or are involuntarily working from home, let’s dive into the different categories available as claiming expenses. Please give us a call if you have any queries about what you can & can’t claim or what records to keep. The previous grandfathering of the exemption applying to certain large proprietary companies from the normal obligation to lodge their annual reports with ASIC was also removed. Taxpayers running afoul of the taxman will find themselves facing bigger bills this year after the Federal Budget included measures to increase the fines for regulatory penalty units.

There were no significant tax changes affecting small business in the October 2022 Federal Budget, although there was a big focus on tax compliance. A home-based business is one where your home is also your principal place of business. That is, you run your business at or from home, and have a room or space set aside exclusively for business activities. His employer provides him with the equipment necessary to fulfil his work functions and they pay for a work, health and safety check on the room he uses for working at home. You must also apportion your expenses on a time basis if you only use that area of your home for work purposes for part of the year. Any items where your employer pays for or reimburses you for the expense.

Calculate your work from home deduction

If you have a dedicated home office space and it is your core place of work, you’ll be able to claim occupancy expenses. Today, of course, many more people are working from home and, as a result, employee outlays for things like faster Internet connections, upgraded home networking gear, desks and the like are up. Travel and entertainment expenses are down, again as a result of pandemic-related travel decline. But home office expenses of whatever variety are no longer deductible except for a handful of exceptions. Use the temporary shortcut method to work out your working from home deduction between 1 March 2020 and 30 June 2022. If you carry on a home-based business, you need to use the right method to calculate your expenses based on your business structure.

The employer will then be able to deduct the reimbursements as business expenses. Once you calculate your deduction, enter the amount at Other work-related expenses in your tax return. If you’re entitled to goods and services tax input tax credits, you must claim your deduction in your income tax return at the GST exclusive amount.

Super

Their thinking was, you are not going to have any additional running expenses for that area, if the space is being used for other things anyway. It’s an easy way to make a claim for these items without trying to apportion a work vs personal amount for each one. Just keep a diary of how many hours you work from home each week and enter it on your tax return. Please note all of these expenses must be recorded and essential to your employment duties.

Under the shortcut method, Bianca can now claim all her expenses under a rate of 80 cents per hour. If applicable, mobile phone and internet costs as well as computer consumables and stationery can be separately added to the claim. However, the ATO’s new “80 cents deduction method” covers ALL your expenses from working at home, so be careful. You can’t claim other, itemised expenses like phone, internet or computer use if you use the 80 cents method. And that’s why the ATO’s short cut method just might cut your tax refund short.

Shortcut method 80 cents per hour for all costs, from 1 March 2020 to 30 June 2022. Draft Practical Compliance Guideline PCG 2022/D4 sets out the basis of a revised fixed rate method to apply from 1 July 2022. To establish a claim of more than $50, a 4-week representative period of expenditure can be used to establish a percentage claim of the total cost of calls and data contained in itemised billing records. Records include diary entries, electronic records, and bills, along with some evidence from the employer that work from home or work-related calls are expected. Apportioned business internet usage can be estimated based on records of actual usage maintained for the year or in stable usage circumstances a representative 4 week period will suffice.

It is important to note that not all items you buy for an office are deemed essential. An armchair or sofa, for example, is not furniture that would be eligible for deductions. These may be added for aesthitics, but they’re not directly for work related use. Employees generally can’t claim for any occupancy expense such as rent or mortgage interest, but can claim for running costs such as internet costs, heating, lighting or cleaning related to working.

This gives you a fixed rate of 52 cents per hour worked at home deduction. The fixed rate method is great if you have your own dedicated work area, phone and your own internet for work. The original 52 cents per hour method does not include other expenses such as, phone and internet costs, computer consumables, stationery or the work related portion of the decline in value of office equipment. You claim each of those items separately, and usually get a bigger refund. We go into more detail with examples of this on our dedicated “working from home due to COVID-19” article.

The temporary shortcut method simplifies how you calculate your deduction for working from home expenses. Before claiming a deduction for working from home expenses, you need to understand your circumstances. The information below is for employees, if you're running a home-based business, see Deductions for home-based business expenses.

Your tax return

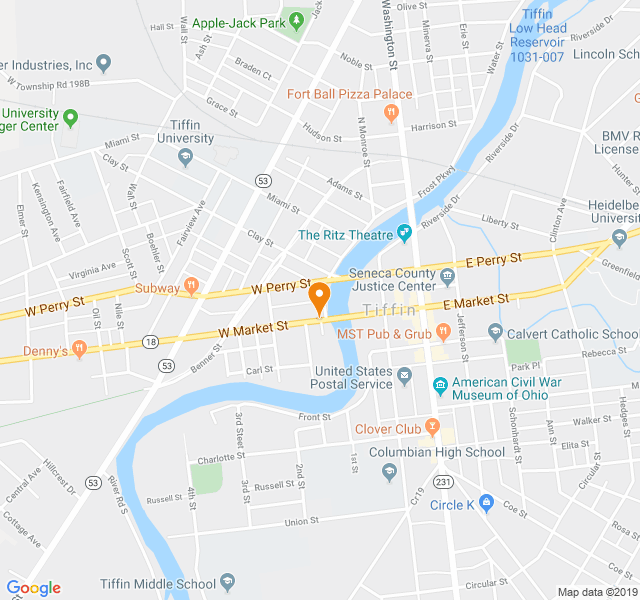

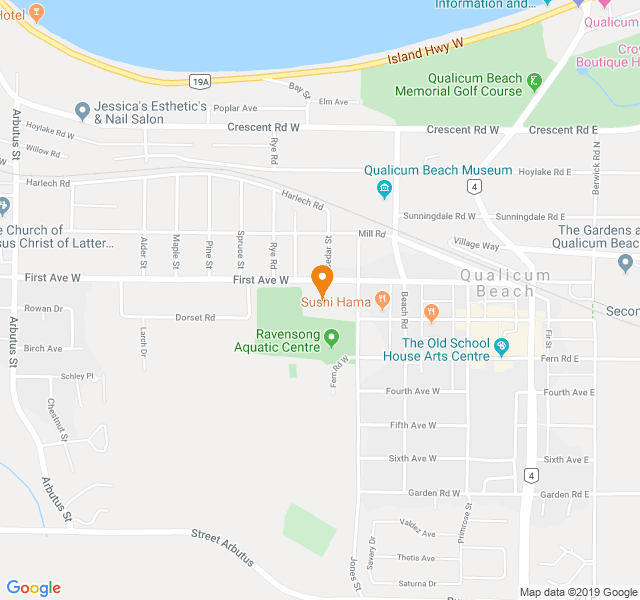

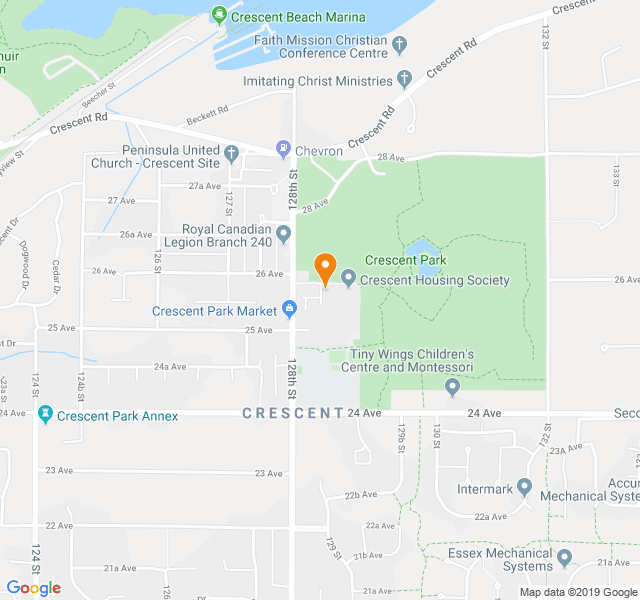

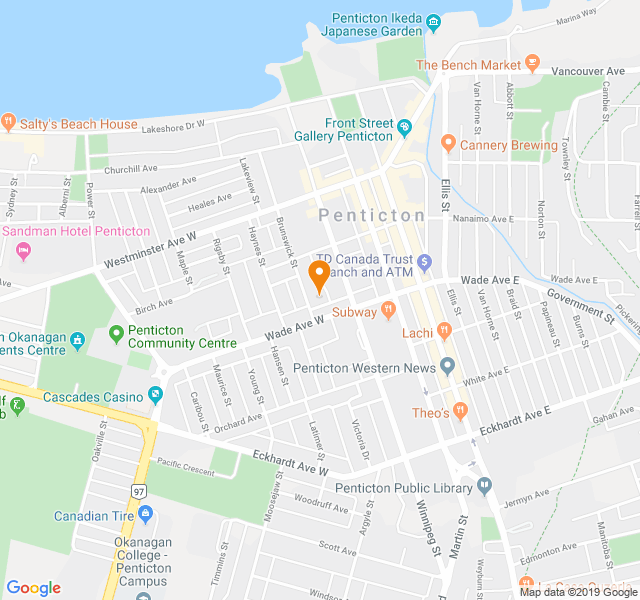

One way to get the jump on paying taxes or just checking that you’re paying the right amount in federal taxes is to use a tax calculator. Deducting expenses for working from home can get complicated and an experienced financial advisor can be a great help. SmartAsset’s free toolmatches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you.

You essentially have to prove all expenses and their actual costs in relation to your work. This manual approach would entail logging your energy usage, internet usage, kilometres driven and phone time spent, for example, and working out the work related proportion. The granularity of this approach would mean that you would have to look at your usage per hour and calculate consumption based on your working hours – and consider your lunch break times too. Since the shift to remote (Covid-19 safe) working, you can claim tax deductions for the time you did working from home, including deductible running expenses. Bianca can also decide to claim using existing working from home calculations. If work from home is your “new normal”, then you probably use your own internet, phone and power for work purposes – plus, in some cases, your computer, equipment and furniture.